Employee retention was the biggest consideration impacting on organisational pay policy according to two-thirds of respondents to this year’s survey. Other major factors were inflation and skill shortages. The increase in the National Minimum Wage was a key driver for 21%, and 9% called out the gender pay gap.

Pay

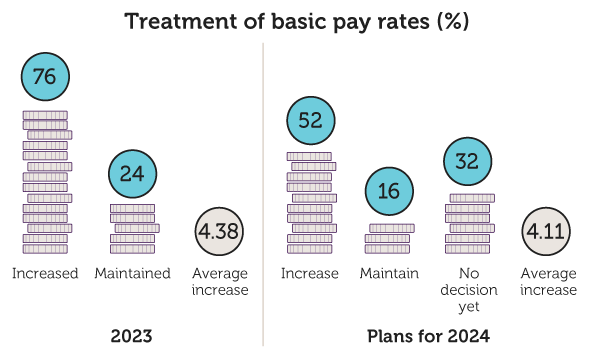

Three-quarters of respondents reported increasing basic pay in 2023, reflecting the pressure on pay and the tight labour market. A year ago, only 52% had planned to increase basic pay in 2023, though over a third had not yet decided. This is an annual pattern in which the proportion who had not made a decision on pay for the upcoming year eventually decide to give a pay increase.

The average pay increase in the last 12 months was 4.38%, 0.76% higher than the increase companies had planned for 2023. Pay increases were just below the rate of inflation, as measured by the Consumer Price Index which showed prices were 4.6% higher in December 2023 than in December 2022.

Played out again last year was a trend we identified in previous years regarding lower increases being paid in unionised organisations (3.52%), large organisations with over 250 employees (4.19%), and the manufacturing sector (4.04%). All organisations except unionised companies made higher than planned pay rises in the last 12 months. Non-union companies paid out the most, at 4.84%, followed by smaller companies with up to 50 employees who increased basic pay by 4.7%. Non-union and smaller companies delivering the highest base pay increase has been a consistent trend in recent years.

Projections for 2024

Projections for the next 12 months show that over half of respondents (52%) are planning an increase in base pay, while 16% hope to maintain current rates and 32% are yet to decide. Organisations are planning an average basic pay increase of 4.11% for 2024. This breaks down into a planned increase in 2024 of 3.94% in unionised organisations versus 4.33% in non-unionised organisations. The lower increases in unionised companies is a trade-off for predictability. There were also big variations in planned increases in different industries, from services at 4.4% to manufacturing at 3.22%. These increases are higher than the predicted inflation rate for Ireland for 2024 – generally ranging from 2% to 3%.

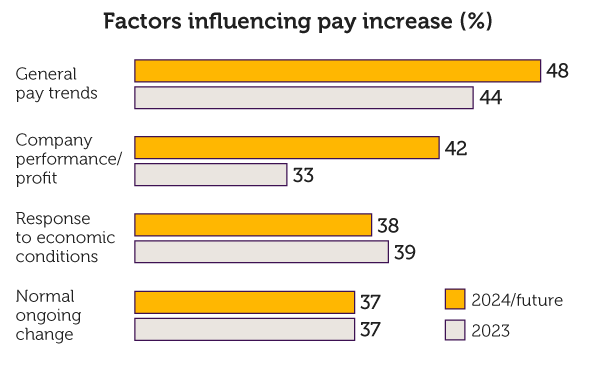

Employee retention is currently the biggest factor influencing pay policy among 65% of employers. Inflation was also identified as a significant driver of pay by 54% of organisations. Our respondents indicated that increases would be contingent on general pay trends (48%) and performance and profitability (43%).

While individual performance influences the pay increase individuals would receive, general pay trends and company performance have both grown in significance as a consideration.

Two-thirds of respondents are planning to pay bonuses in 2024, a drop from the 74% who planned bonus payments in 2023. Two-fifths (39%) plan to make them available to some employees, and 26% plan to make them available to all employees (11% less than last year).

How this may have been impacted by the introduction of gender pay gap reporting is unclear. Since December 2022, organisations with over 250 employees have had to report their gender pay gap, including the gap in bonus payments. Many company reports indicated that men were being paid significantly larger bonuses than women. A reduction in the volume of bonus payments may be a step towards addressing this gap.

On a positive note, over 80% of companies are planning to either maintain or increase employee numbers. However, 8% are expecting to cut back the number of employees in 2024.

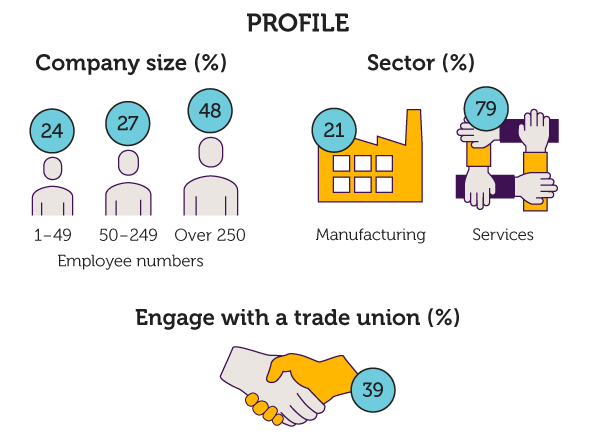

Collective bargaining

This year, the proportion of respondents engaging with a trade union for collective bargaining purposes sits at 39%, up from 29% in our 2022 report. Of the non-unionised companies surveyed, only 1% (down from 4% last year) were open to considering engaging with a trade union for the purposes of collective bargaining; others were undecided or unwilling to engage.

The sensitivity around this topic stems from the Irish Government’s pledge to follow EU developments which require Ireland to promote better representation of workers in the workplace. Developments at an EU level are putting greater emphasis on consultative processes to address pay anomalies.

Among unionised companies, the preferred length of pay agreements continues to be 19-24 months, with 71% having a preferred length of 18 months or more. According to respondents, this is mainly for planning (68%) and stability (56%) purposes. As mentioned above, we can see more predictability in pay increases planned for 2024 in unionised companies, a trade-off for lower increases, at 3.94% versus 4.33%.

Non-pay benefits

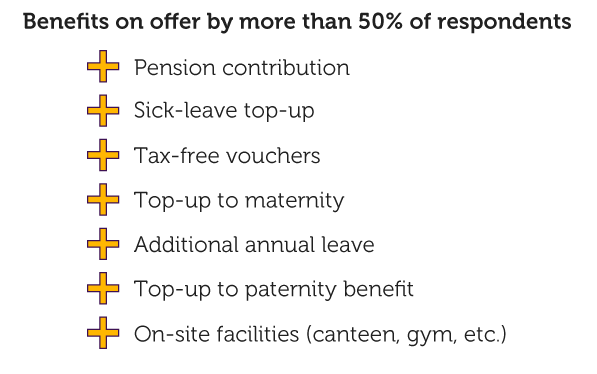

With employee retention as the top driver of pay, one quarter of employers plan to increase their non pay benefits in 2024, down from 37% in 2023, with a further 50% will maintain their benefits this year.

Top benefits are pension contribution (78%), paid sick leave (75%), and the allocation of tax free vouchers (62%).

There was little practical support offered to those affected by the housing crisis. However, respondents ranked the impact of the housing crisis on the people agenda as follows:

- pressure on pay/benefits (72%)

- demand for hybrid/remote working (67%)

- attracting top talent (65%) and

- recruiting employees (63%).

There were also indications that the crisis is impacting employee wellbeing (60%), diversity of the workforce (48%) and employee retention (45%).

Where is HR focussing?

Three-quarters of respondents ranked “reinvest in your company culture” as a top issue for their organisation in the coming 12 months, unchanged from 2023. Demand to work remotely is the second biggest issue, identified by 51% of people professionals. Just under half of respondents indicated that resistance to returning to the office was an issue. Additionally, employees wanting to work outside of Ireland appears to be rising, with 40% of employers highlighting this as an issue they are facing this year.

People policies

When it comes to workplace policies, it is encouraging to see more attention being fixed on the employee experience, with an increased uptake of progressive people policies. For instance, the proportion of respondents considering or implementing a miscarriage policy has increased to 56%, and 51% for fertility policies. Although still relatively low, it is good see more organisations considering a menstrual health policy (31%) and a men’s health policy (35%). The ongoing education and awareness around menopause over recent years is having a positive impact as our research found 60% of employers are implementing or considering a menopause policy.

The most significant forward step has been in relation to domestic abuse policy, with 48% implementing a policy and another 26% considering one. This is in no small part due to recent legislative developments providing a new legal entitlement of five days paid domestic violence leave over a 12-month period, to be paid by the employer.

Given the ageing workforce in Ireland, it is imperative to have retirement planning in place, and reassuringly 60% of respondents reported having this support available. However, only 18% had provisions in place to train managers in age-friendly practices and only 24% had training for their ageing employees. Most of the organisations surveyed had not conducted an age audit (69%) and did not have strategies (66%) or age-friendly benefits (77%) in place for the ageing workforce. There is growing urgency around adopting age-friendly workplace practices to support and retain older workers, and make workplaces more attractive to that cohort.

Impact of new legislation

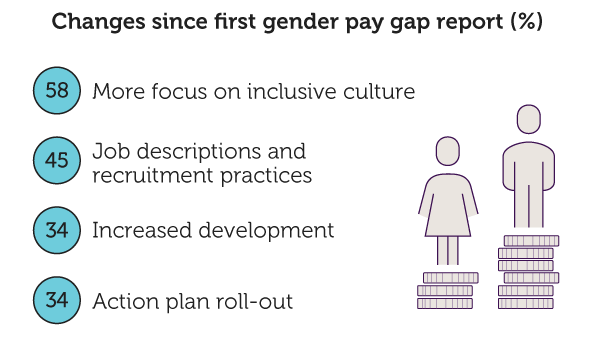

Almost half of the respondents had published a gender pay gap (GPG) report in the last 12 months, currently a legal requirement for all organisations with over 250 employees. In this survey, respondents identified the primary change as a result of GPG reporting was more focus on an inclusive culture (up from 41% to 58%). Other positive impacts were around improved recruitment practices and job descriptions (45%), the roll-out of action plans (34%), increased development (34%) and improved people policies (28%).

The perceived impact of the protected disclosures legislation is surprising, with 63% saying it will have low or no impact. This shows the need for further education as protected disclosures channels have to be put in place in 2024 for organisations with 50 or more employees. This is also critical as claims on this in the Workplace Relations Commission carry the heaviest possible fines – up to five years’ salary.

Two-in-five organisations reported feeling a high impact from implementing the obligations under the Sick Leave Act, as it has been a significant cost-increasing measure for some organisations, especially those with no previous sick pay scheme.

Building on gender pay gap reporting, there are further changes in the pipeline in relation to equal pay. The forthcoming EU Directive on Pay Transparency is due to be enacted into Irish legislation by June 2026. Respondents believe there will be a medium-to-high impact as a result of requests from employees for information on the average pay for those doing “like” work (54%), and also for having to put pay ranges into job advertisements (57%). Just over half indicated a medium-to-high impact with respect to the burden of proof passing to employers in equal pay claims and having to be part of a joint pay assessment where the gender pay gap is at least 5% or above.

Archive

Reports

Our tenth annual CIPD-IRN private sector report examined pay and employment trends in Ireland in 2023

Connect with our team

in Ireland

Join with us in championing better work and working lives across Ireland

CIPD Ireland

Annual Conference

Join us on 09 May in the RDS, Dubin to discover how we can lead positive change.

About the authors

Mary Connaughton, Director for the CIPD in Ireland

Mary leads the growth, development and contribution of the people profession in Ireland. She pushes forward our agenda of people-centric decisions, wellbeing, inclusion and flexible working through research, policy and member engagement.

Mary has a wealth of HR experience, supporting individuals and companies on the strategic people agenda, HR practice and organisation development. Previously she headed up HR Development at employers’ group Ibec, consulted widely across the public and private sector and held organisation development roles in the financial and consulting sectors.

Mary is on the Boards of the Public Appointments Service and the Retirement Planning Council and represents the people profession in Ireland at the European Association of People Management.

Meg Dunphy, HR Policy and Engagement Manager

Meg is an experienced HR professional, previously working in HRBP roles for Irish public sector and global enterprises. She has a passion for showing the impact of the people profession through creating positive workplace culture. She is qualified to Masters level and is a lifelong learner in the field of people management.

Meg chaired the CIPD Southeast committee in Ireland for 4 years. During that time, she built strong networks providing key learning events and networking opportunities within her region and on the national committee. She began her role as HR Policy and Engagement Manager in August 2022, where she creates value for CIPD customers through the annual calendar of engagement, developing relationships with key stakeholders and wider business community.

Analysis of the status of gender pay gap reporting in Ireland as large organisations produce their second annual reports

Our tenth annual CIPD-IRN private sector report examined pay and employment trends in Ireland in 2023

Information on the Gender Pay Gap Information Act 2021 and the EU Pay Transparency Directive

Information on the legal issues relating to employers’ pension obligations and the law relating to voluntary tips and gratuities

Find out about the importance of neuroinclusive workplaces, what employers are doing and the working experiences of neurodivergent and neurotypical employees

Insight into how global issues are impacting people professionals in the UK, Ireland, Asia-Pacific, MENA and Canada

Insight into how global issues are impacting people professionals in Australia, Hong Kong, Malaysia and Singapore

Insight into how global issues are impacting people professionals in Egypt, the Kingdom of Saudi Arabia and the United Arab Emirates